Forecasting Jeju Island Tourism Revenue

1. Introduction

Time series analysis is a powerful tool for understanding

trends, patterns, and relationships in sequential data.

This

project focuses on analyzing the relationship between the number of

monthly foreign tourists visiting Jeju Island and the corresponding

tourism revenue. By leveraging advanced time series modeling techniques,

we aim to provide meaningful insights into the dynamics of tourism and

its economic impact.

2. Goal

This project aims to predict monthly tourism revenue based on

the number of foreign visitors to Jeju Island using Transfer Function

Models and ARIMA modeling. By identifying and quantifying the

relationship between these variables, the analysis provides actionable

insights to support strategic decision-making in the tourism sector.

3. Figure

1-1. Plotting

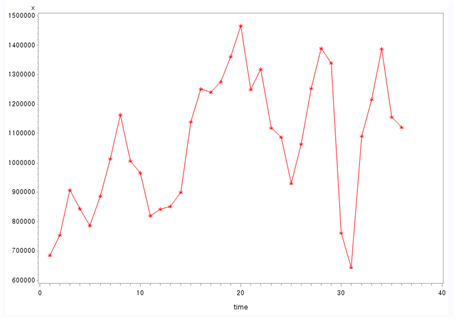

The following process was conducted to analyze monthly data of

foreign tourists and tourism revenue over time.

Raw Time Series Plots

symbol1 i=join v=star ci=red;

proc gplot data=travel;

plot x*time=1;

run;

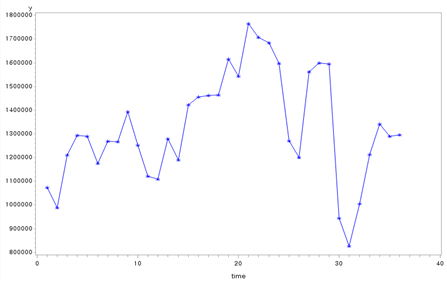

symbol1 i=join v=star ci=blue;

proc gplot data=travel;

plot y*time=1;

run;

[Fig. Monthly Foreign Tourist Count (x)]

[Fig. Monthly Tourism Revenue (y)]

From the raw plots, it was determined that variable transformation

was necessary to stabilize the variance, although differencing was not

required.

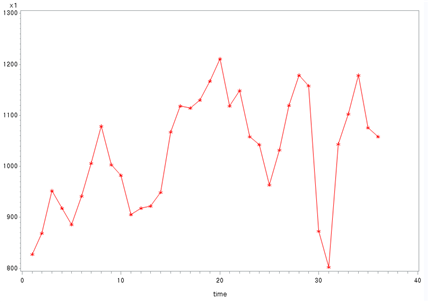

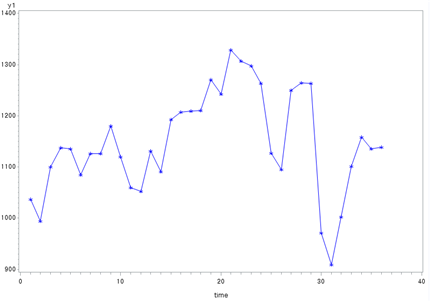

Square Root Transformation

data travel1;

set travel;

x1 = sqrt(x);

y1 = sqrt(y);

[Fig. Transformed Monthly Foreign Tourist Count (x1)]

[Fig. Transformed Monthly Tourism Revenue (y1)]

The transformed plots indicate that the variance has been stabilized.

These transformed data will be used as the basis for further analysis,

starting with the identification of ACF and PACF.

1-2. Model Identification

ACF and PACF Analysis

symbol1 i=join v=star ci=red; proc gplot data=travel1;

plot x1*time=1;

run;

symbol1 i=join v=star ci=blue; proc gplot data=travel1;

plot y1*time=1 ;

run;

proc arima data=travel1; identify var=x1 ;

run;

proc arima data=travel1; identify var=y1 ;

run;

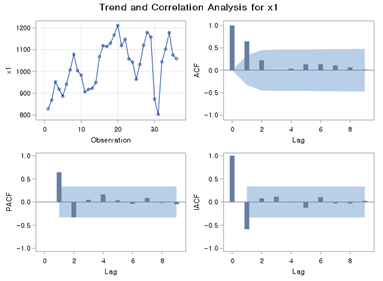

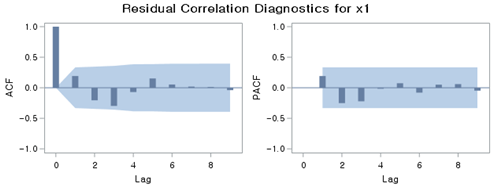

[Fig. Trend and Correlation Analysis for (x1)]

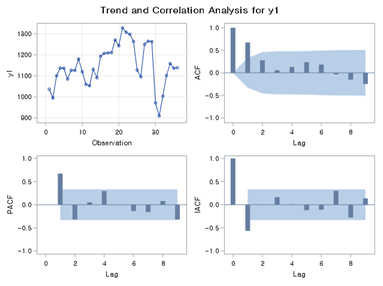

[Fig. Trend and Correlation Analysis for (y1)]

- The transformed input series (x1) and output series (y1) were

analyzed using their respective ACF (Autocorrelation Function) and PACF

(Partial Autocorrelation Function) plots.

- Both the AR (Auto-Regressive) and MA (Moving Average) components

show significant spikes at lag 1, suggesting \(p = 1\) and \(q =

1\).

ARIMA Model Selection

Candidate ARIMA

models for the input series \(x_1\):

/*ARIMA((1),1,0)*/

proc arima data=travel1; identify var=x1 ; estimate p=(1) plot;

run;

/*ARIMA(0,1,(1))*/

proc arima data=travel1; identify var=x1 ; estimate q=(1) plot;

run;

/*ARIMA((1),1,(1))*/

proc arima data=travel1; identify var=x1 ;

estimate p=(1) q=(1) plot; run;

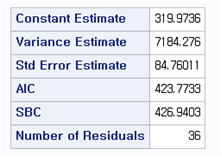

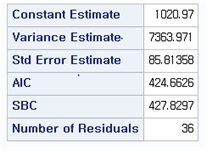

[Fig. ARIMA((1), 1, 0) ]

[Fig. ARIMA(0, 1, (1)) ]

[Fig. ARIMA(0, 1, (1)) AIC ]

[Fig. ARIMA(0, 1, (1)) AIC ]

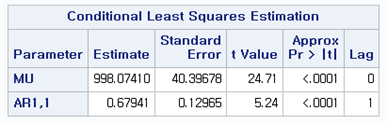

Based on the AIC (Akaike Information Criterion), ARIMA((1), 1, 0) was selected as the most appropriate model due to its lower AIC value and significance in parameter estimates.

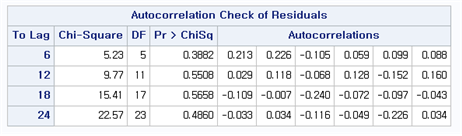

[Fig. Portmanteau Test Results for the ARIMA((1), 1, 0) Model ]

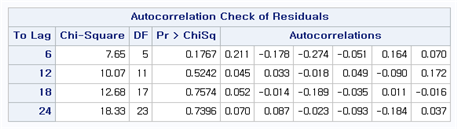

[Fig. Portmanteau Test Results for the ARIMA(0, 1, (1)) Model ]

[Fig. ARIMA((1), 1, 0) ACF, PACF ]

Residual diagnostic checks (Portmanteau test) confirmed no significant autocorrelation in the residuals of ARIMA((1), 1, 0), validating the model.

Final Model

The final model for \(x_1\):

\[ (1 - 0.6794B)(1 - B)X_t = a_t \]

where \(B\) is the lag operator.

1-3. Prewhitening Process

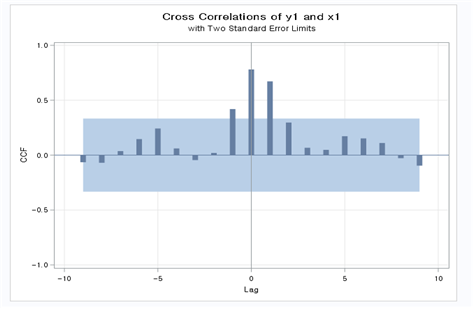

The cross-correlation function (CCF) between the input

series \(x_1\) and the output series

\(y_1\) was analyzed.

proc arima data=travel1; identify var=y1 crosscorr=x1; run;

[Fig. CCF Plot (Cross-Correlation Function Plot) ]

From the CCF plot, the following \((b,

r, s)\) values were estimated:

- \((b, r, s) = (0, 2, 1)\)

- \((b, r, s) = (0, 1, 1)\)

- \((b, r, s) = (0, 0, 1)\)

These values were used as candidates for further model estimation.

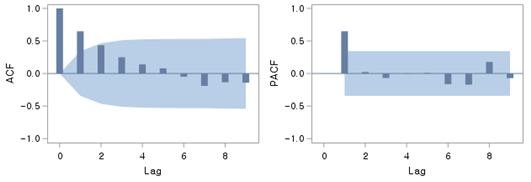

1-4. Noise Series \(n_t\) Model

Initially, the transfer function model with \(b = 0\), \(r =

2\), and \(s = 1\) was

estimated, and the corresponding ACF and PACF plots for the residuals

were generated.

[Fig. ACF and PACF Plots for Residuals of the Transfer Function Model

with \(b = 0\), \(r = 2\), and \(s

= 1\) ]

- The residuals were not white noise, indicating that further adjustments to the model were necessary.

- An ARMA model with \(p = 1\) and \(q = 1\) was applied to refine the noise series model.

proc arima data=travel1;

identify var=y1 crosscorr=x1;

estimate p=1 q=1 input=(0$(1)/(0)x1) noconstant plot; run;

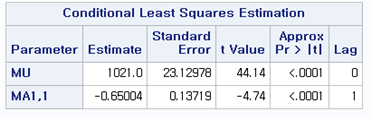

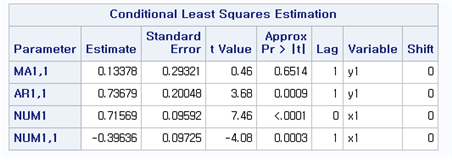

[Fig. stimated Parameters for the Final Model (b = 0, r = 0, s = 1) ]

- This table shows the estimated parameters for the final transfer

function model with \(b = 0\), \(r = 0\), and \(s

= 1\).

- All parameters are statistically significant, confirming the suitability of this model.

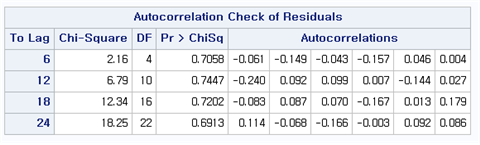

[Fig. Portmanteau Test Results for the Final Model ]

- The results indicate that the residuals of the final model exhibit no significant autocorrelation, as all p-values are large.

- This confirms that the residuals behave as white noise, validating the adequacy of the final model.

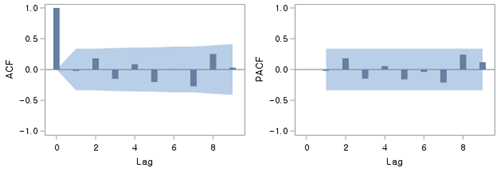

[Fig. ACF and PACF Plots for the Residuals of the Final Model ]

- These plots visually confirm that the residuals of the final model show no significant autocorrelation.

- The results further support the conclusion that the model captures the underlying structure of the data effectively.

The results of the Portmanteau test indicate that the

p-values are large, confirming that there is no autocorrelation in the

residuals.

Additionally, the estimated parameters of the model are all

statistically significant.

The ACF and PACF plots of the residuals further demonstrate that \(n_t\) behaves as white noise.

Therefore, the ARIMA(0, 0, 1) model is selected as the

final model.

The final model is as follows:

\[ (1 - B)Y_t = \frac{0.71569}{1 - 0.39636B}BX_t + a_t, \quad \hat{a}_t = 380.9856 \]

Model Summary:

- Variance Estimate: 2807.963

- Standard Error Estimate: 52.99021

- AIC: 380.9856

- SBC: 387.207

- Number of Residuals: 35

Model Components:

- Autoregressive Factors: \[ 1 - 0.73679B^{1} \]

- Moving Average Factors: \[ 1 - 0.13378B^{1} \]

- Input Variable: \(x_1\)

- Numerator Factors: \[ 0.71569 + 0.39636B^{1} \]

3. Methodology & Summary

Data Preprocessing:

- Monthly data for foreign tourist counts (\(x\)) and tourism revenue (\(y\)) were transformed using a square root transformation to stabilize variance.

- Cross-correlation analysis (CCF) was used to identify the lag

structure between \(x_1\) (transformed

tourist counts) and \(y_1\)

(transformed revenue).

Model Development:

- Multiple transfer function models were estimated for combinations of \((b, r, s)\), where the final model with \(b = 0\), \(r = 0\), and \(s = 1\) was selected based on the Portmanteau test and residual diagnostics.

- The final model coefficients were statistically significant, with

residuals behaving as white noise.

Final Model:

- The chosen ARIMA model for the input series \(x_1\) and its impact on the output series \(y_1\) is represented as: \[ (1 - B)Y_t = \frac{0.71569}{1 - 0.39636B}BX_t + a_t, \quad \hat{a}_t = 380.9856 \]

- The model achieved high accuracy with a low variance estimate of

2807.963 and an AIC value of 380.9856, demonstrating its predictive

capability.

Significance of Results:

- The model effectively captures the relationship between foreign tourist counts and tourism revenue, making it suitable for short-term forecasting.

- These findings can guide tourism stakeholders in optimizing marketing strategies and resource allocation.

5. Conclusion

This project successfully analyzed the relationship between

monthly foreign tourist counts and tourism revenue using transfer

function models and ARIMA modeling.

The key findings include:

Variance Stabilization: The square root

transformation proved effective in stabilizing variance, improving model

fit.

Optimal Model Selection: The final transfer function

model (\(b=0\), \(r=0\), \(s=1\)) accurately captured the dynamic

relationship, supported by statistically significant coefficients and

white noise residuals.

Practical Implications: The model provides actionable insights for forecasting future revenue trends based on expected tourist numbers.